Financial Institutions (FI) file Currency Transaction Reports (CTRs) which enable law enforcement to monitor and investigate potentially suspicious activity. CTRs act as a paper trail for cash transactions, and are filled out by bank personnel for each deposit, withdrawal, currency exchange or other payment or transfer greater than $10,000 in currency. In turn, the Financial Crimes Enforcement Network (FinCEN), a branch of the U.S. Treasury, reviews and correlates the customer and transaction data, and maintains a database of all filings.

Nearly 50 years ago, CTRs came into existence under the Bank Secrecy Act (BSA), which established program, recordkeeping, and reporting requirements for FIs. Since then, the CTR form has been modernized several times to streamline and simplify submission requirements, and an electronic filing requirement for all CTRs was instituted. Beginning in the 1990s, FinCEN sought to reduce unnecessary regulatory burdens on filers and eliminate items which are of limited value to law enforcement. To reduce information collection, criteria were established to exempt transactions from CTR reports by certain entities.

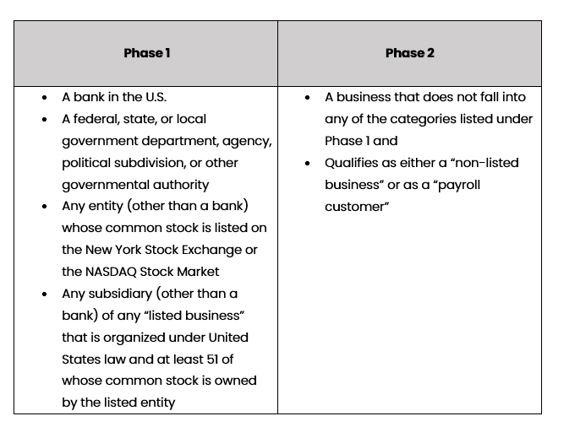

The Money Laundering Suppression Act of 1994 established a two-phase exemption criteria. Under Phase 1, transactions conducted by banks, government departments or agencies, and listed public companies and their subsidiaries are exempt from CTR reporting. Under Phase 2, transactions in currency by businesses that meet specific requirements are exempt from CTR reporting.

Here is a table which outlines the Phase 1 and Phase 2 exemptions:

Under Phase 2, FIs may exempt commercial entities which do not fall within any of the categories listed under Phase 1 if: they conduct legitimate business activity (such as payroll to employees); they maintain a financial account for a certain period of time (two months); they are incorporated and eligible to do business in the U.S.; and the FI, in its risk based review, has a reasonable belief that the customer has a legitimate business purpose for conducting large currency transactions.

There are certain businesses which are ineligible for exemption from CTR reports under Phase 2; these include any business which is engaged in certain activities including, but not limited to, practicing law, accounting, and medicine, engaging in gaming or trade union activities, or operating a pawn brokerage or real estate brokerage business.

Exemptions from CTR Reports

Despite the valuable insight CTRs provide law enforcement, a high number of CTRs relate to ordinary non-suspicious business transactions. Although the exemption criteria were enacted to alleviate this concern, FIs of all sizes exempt only a tiny fraction of their eligible customers. Moreover, exempting customers requires a notable commitment by bank personnel, and the process is quite burdensome. First, a FI must make an initial designation of the customer as an “exempt person” by filing a Designation of Exempt Person report within thirty days of the customer becoming eligible for the exemption. FIs must retain documentation supporting eligibility for the CTR exemption. Second, the FI must analyze the customer’s transactions each year and monitor for its continued exemption status and suspicious activity. This includes ensuring customers meet transaction requirements (for Phase 2 exemptions) and if the exempt customer is engaging in any ineligible business activities. Therefore, in considering whether to expand the number of Phase 2 exemptions, FIs need to carefully weigh the cost of performing additional monitoring in order to maintain the exemption against the value of reducing the number of CTRs prepared, reviewed and filed each year.

Regulatory proposals aimed at improving the CTR exemption process include adopting a revised exemption process that would enable FIs to more easily exempt business customers, particularly customers with a longstanding history with the FI, and raising the CTR threshold. The notion of raising the threshold in particular has sparked an interesting discussion. The current $10,000 threshold was established nearly 50 years ago, and has not been adjusted to account for inflation since then. At the time of enactment, the original $10,000 threshold is the equivalent of $60,000 today. Recent proposals in favor of raising the threshold argue that $30,000 is more in line with today’s financial standards. Proponents argue that raising the threshold would significantly reduce unnecessary regulatory filings associated with BSA compliance for FIs and make the CTR reporting process more efficient for seasoned business customers. However, opponents argue that raising the threshold would result in limiting data available to law enforcement to monitor suspicious transactions, and would allow criminals to deposit larger sums of illicit proceeds without law enforcement awareness.

In testimony before Senate Committee on Banking, Housing and Urban Affairs, November 29, 2018, Kenneth A. Blanco the Director of FinCEN stated: Increasing the threshold to $30,000 would result in a loss of close to 80 percent of currently provided data—in this case, the type of data points that enable the identification of illicit networks and the initiation or expansion of investigations.[1]

Irrespective of changes to the reporting thresholds, regulators should continue to explore ways to promote continued cooperation by FIs while exposing suspicious activity.

[1] https://www.banking.senate.gov/imo/media/doc/Blanco%20Testimony%2011-29-18.pdf