-

“There are some decades where nothing happens, and some weeks where decades happen” – Vladimir Il’yich Ulyanov (Lenin)

Coronavirus has changed the world. But the changes it will accelerate have been brewing for years.

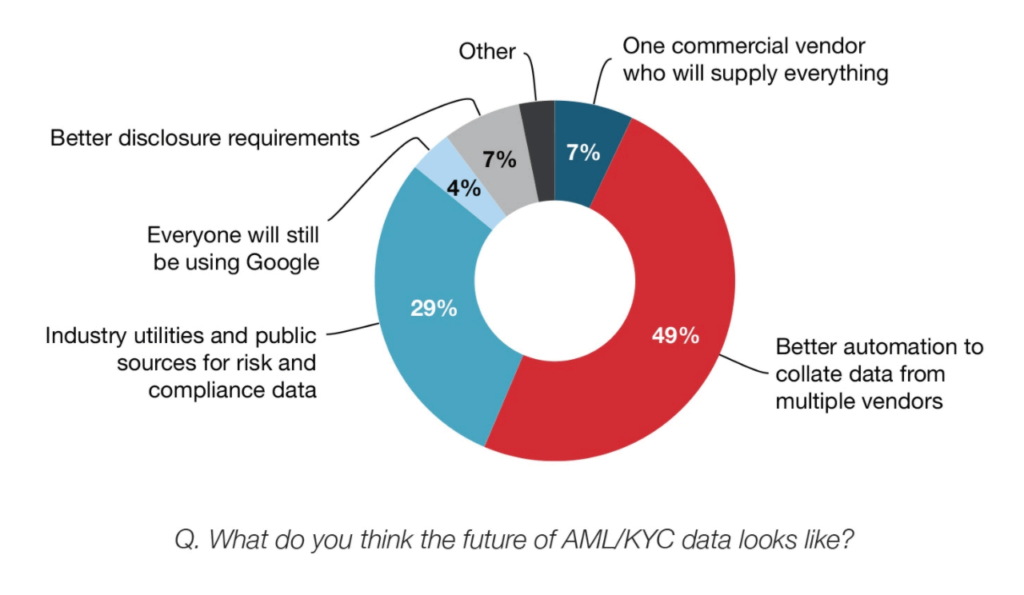

Those of us who are working remotely with our bank partners, many of whom are working from their studies, living rooms or kitchens, have been thinking about how the AML and KYC world is going to change over the next few years. Some of those changes pre-dated the current crisis; we at Arachnys polled customers, partners and other stakeholders earlier this year to generate our AML/KYC Data Survey. But many will be accelerated by the crisis.

Few in the market feel that they are busy but not too busy. Those I’ve spoken to are either totally consumed by the crisis or feel that covid-19 has in fact created time and space to reflect and improve.

Strategic opportunity

Perhaps it’s the latter group who will add the most to the transformation overall. One manager at a major UK bank told me that, “finally, it feels like there’s the strategic headspace within our organization to really look strategically at the things that we should have been doing for a while. There are nasty scams going on linked to Covid-19, but overall the volume of work has fallen meaningfully due to the economic shutdown. That’s actually giving us the time to reflect on the inadequacies that we’ve allowed to build up in our processes over the past few years. For instance, we’re looking much more carefully about how we think about the use of data, both internal data and external data.” However, she cautioned that physical distance may slow down some big strategic decisions: “getting alignment to make major changes is simply harder when stakeholders are not in one place.”

If these “inadequacies” are finally being brought to light, how then are banks looking to quash them?

Virtual supply chains

Physical supply chains and their failure points have been news since the start of the covid crisis, when China shut to the world. AML does not depend on Chinese-manufactured PPE, but many organizations have moved large parts of their virtual supply chains offshore as part of a decades-long process of outsourcing.

In particular, India going into lockdown has caused some disruption to AML operations for major organizations. With some users only issued desktop computers, workforces had to be reconfigured on the fly as they were not able physically to operate from home.

As the world reconfigures post-covid, it will be interesting to see whether sprawling international operations change to put KYC and AML support nearer the point of consumption to reduce political and operational risk.

The traditional arguments for hubs have been that they allow cost reductions by shifting to low-cost jurisdictions and that they create a centre of excellence and operational proficiency.

The good news is that technology can mitigate the first of these and can transform the second. Processes that previously involved laborious and highly domain-specific training can be reconfigured at the click of a button to reflect a central policy change – meaning even analysts in lockdown (or nearshored closer to local operations) can be instantly redirected.

The historical pattern of economic crises is precisely that they drive adoption of new technologies. The bicycle was invented in the 19th century because of an agricultural crisis that increased the price of oats to the point that horses were forced to starve.

We are now at the point in AML where complex workflows and data federation tasks can be almost entirely automated by tools like Arachnys. Having these structured processes means that training for analysts can be conducted to a far greater degree, which in turn lessens the need for repeated, hierarchical monitoring by QA teams. Changes can be made easily by multiple parties in real-time; maximum efficiency cuts out costly mistakes.

Alternative data to see in shades of gray

The other change that we believe will upend AML over the coming years is that more and more alternative data sets will start to augment, and in some cases even replace, the list services that serve as the first port of call for entity screening in most companies’ AML infrastructure.

Currently, almost every AML process involves screening entity names against some sort of blacklist. This is a poor process for many use cases as it has both a high false positive rate – “low precision” or “low specificity” – and a (very) high false negative rate. Information retrieval theorists call this “poor recall”; in a medical context one talks about “poor sensitivity”. Crucially, it means that decisions and assumptions about risk have been embedded in the process used by the creator of the list. That might be a human curation process or an automated one, but it means that you may have a risk culture mismatch with your provider.

We believe AML investigations will move away from these opaque, black-and-white risk alert systems and instead towards a ‘grayscale’ view of risk, focusing on more niche organisation-specific requirements. As this data would not be based on set criteria, a more holistic and representative risk picture can be built.

These different risk-screening measures could also be enhanced through the use of international trade data to detect AML flags. Being extremely detailed, this data is worthwhile for investigating trade-based money laundering and useful for businesses with a global remit, including those in correspondent banking. Even a sophisticated money launderer will struggle to totally eliminate signs of under- or over-declaration of goods or trade with denied parties or geographies; complex analytical techniques can flag patterns of behaviour where an adversary has gone to significant lengths to cover their tracks.

We can expect an overhaul of how virtual supply chains are viewed. Whereas before the prospect of lower costs in offshoring operations seemed attractive, its importance may instead be overtaken by a firm’s reliance on reliable data that can be gathered through these innovative AML processes. Sophisticated customers are using Arachnys aggregate media data to draw statistical conclusions about networks of risk in a fully automated fashion. These results can be interrogated by an analyst for QA and investigative purposes.

In summary…

- Now is a time when a lot of the automation opportunities that have been available may get actually pushed into production, because cost pressures become overwhelming and the strategic headspace exists

- Automation may lead to rethink of virtual supply chains and may decrease the importance of offshoring as a cost reduction strategy

- We may finally start to see a move away from black-and-white risk flagging systems towards systems that provide a more nuanced, organization-specific and grayscale view of risk

What do you think the coming years hold for AML?